The Trump administration’s threat to impose new tariffs on nearly everything that comes to the United States from China has sent American retailers scrambling. Many rely on China for some portion of their manufacturing, and the new tariffs — as much as 25 percent on the roughly $300 billion worth of goods that so far have been untouched by the trade war — could force the companies to change where and how they make their products.

It means costs could jump, and those higher costs could get passed on to the rest of us.

Everlane, a young brand that was built on the idea of selling luxury apparel at low and transparent markup prices, recently detailed to The New York Times how it’s bracing for tariffs on the garments it makes in China. The company produces about 500 items all told — a relatively small amount in the landscape of American retailers. But the challenges that loom for it illustrate what most chains are dealing with. If and when the American public starts to see higher prices on clothing, the issues that Everlane is grappling with will help explain why.

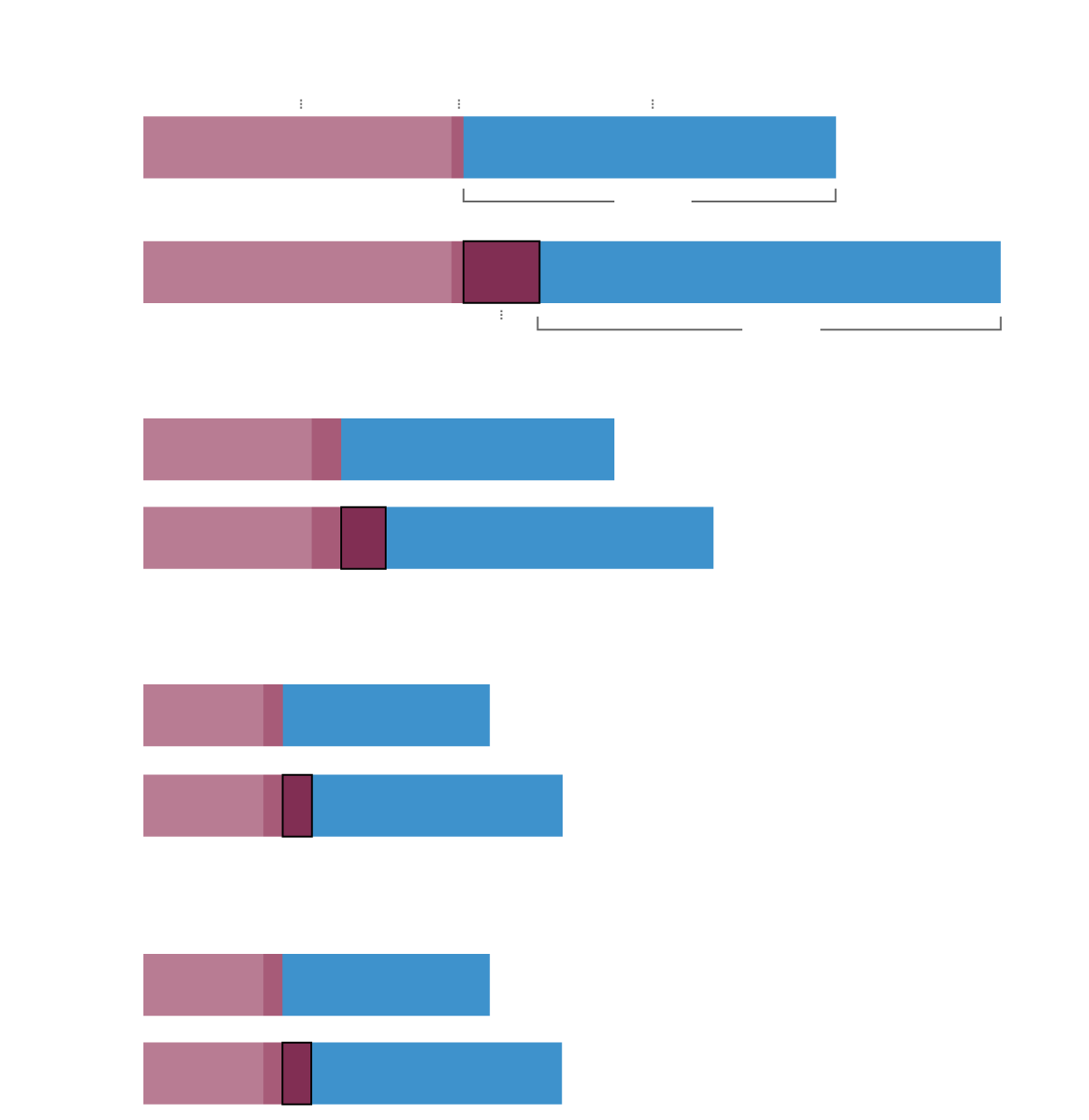

How New Tariffs Could Affect Everlane’s Prices

Women’s cashmere sweater

Profit

margin

Cost of production

and freight

Current

import tariff

$100 retail price

After tariffs

New

tariff

Men’s chino pants

After tariffs

Women’s ankle-length slacks

After tariffs

Women’s cotton sweater

After tariffs

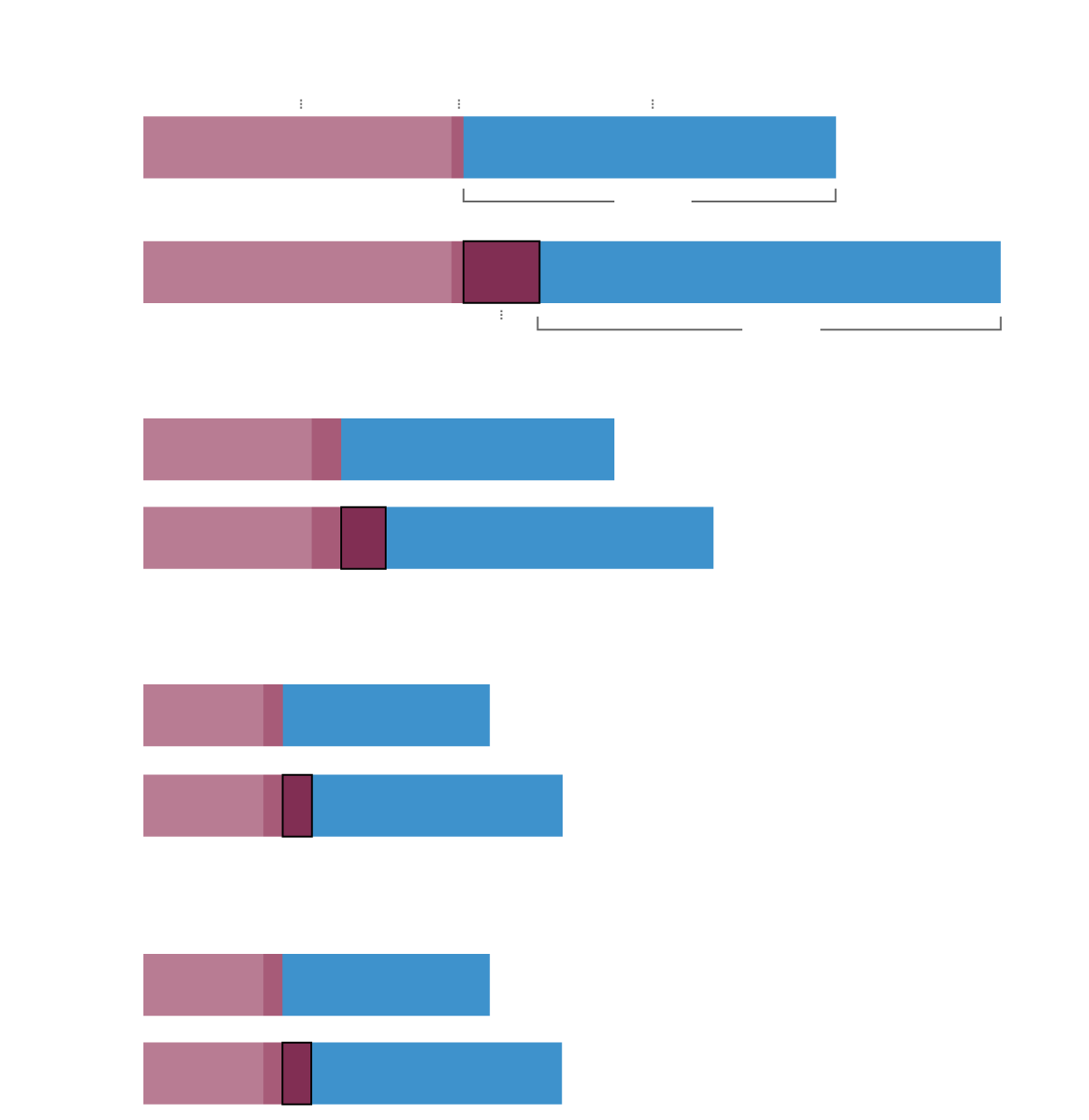

Women’s cashmere sweater

Cost of

production

and freight

Current

import

tariff

Profit

margin

$100 retail

After tariffs

New

tariff

Men’s chino pants

After tariffs

Women’s ankle-length slacks

After tariffs

Women’s cotton sweater

After tariffs

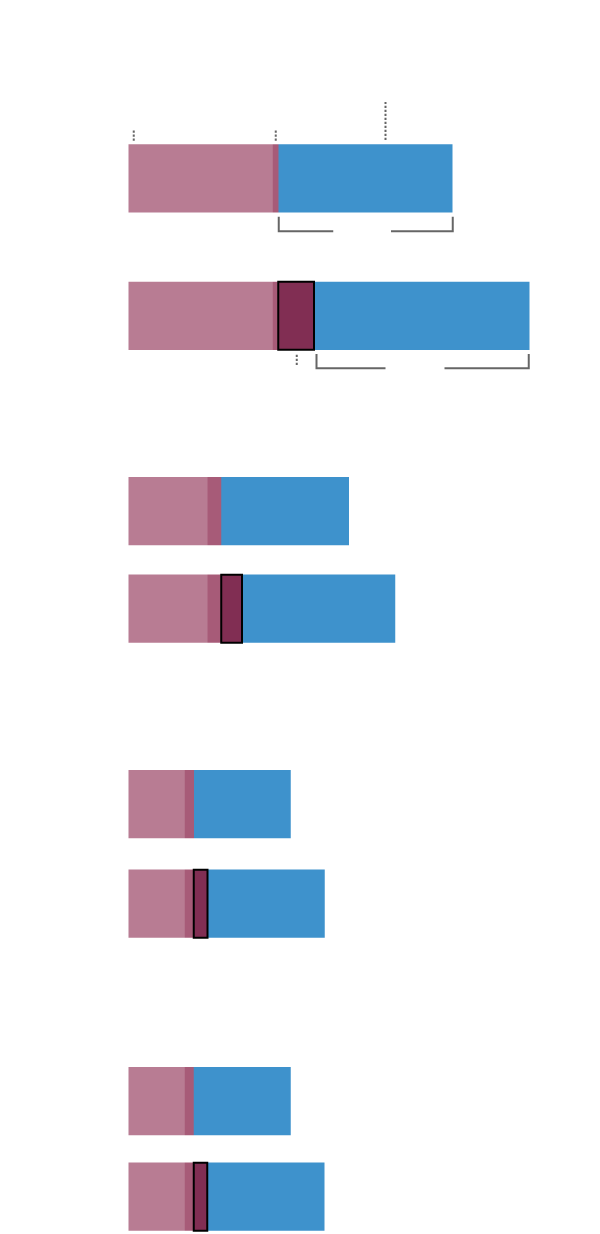

Clothing companies already face varying customs duties, based on fabrics and garment type, when they bring goods into the United States. For instance, Everlane said that it paid a 4 percent duty, or tariff, on women’s cashmere sweaters. The ankle-length pants (categorized as woven women’s pants that are made of more than 50 percent cotton) have a duty of 16.6 percent.

The cashmere sweater retails for $100. Everlane is projecting that price could rise to roughly $124 when the tariffs are enacted. Under the current rules, Everlane pays the factory $43.95 for the sweater and then pays transportation costs and a duty of $2.26. With the new 25 percent tariff, Everlane’s duty would increase by $11 on the sweaters.

If Everlane wanted to maintain its current profit margin of 54 percent for the sweater, it would need to increase the price by more than just the increased duty charge, which is how it arrived at $124.

Though each individual top would bring in more dollars in profit, Everlane assumes that increasing the prices would lead to fewer sales, which is part of why it focuses on preserving the margin.

“There’s been a number of duty adjustments but this is the first time it’s affecting apparel in a major way,” said Michael Preysman, Everlane’s chief executive, who introduced the label in 2011. “In the past, it was focused on other products and materials.”

Everlane, a young brand that was built on the idea of selling luxury apparel at low prices, is one of the retailers preparing for major changes that could be brought on by the tariffs.CreditJustin Kaneps for The New York Times

The impact of the tariffs on retailers will depend a lot on how reliant they are on Chinese manufacturers. It may end up benefiting extra low-priced retailers, which have already moved away from the country to cheaper nations in recent years, Mr. Preysman said.

“We will look at how we may potentially take some of the hit ourselves, which lowers our profitability and lowers the profitability of all the public retailers as well, and then we’ll look at how do we move as quickly as possible if prices go up,” Mr. Preysman said.

He added, “This is the most major governmental issue we have dealt with that has impacted our business.”

The Trump administration has made wide use of tariffs with trading partners around the world. The latest move involves Mexico. President Trump has vowed impose a 5 percent tariff on all goods from the country beginning Monday and to increase the tax to 25 percent by October unless the Mexican government stops migrants from crossing the United States border.

Everlane, which is based in San Francisco, points out the factories that it works with around the world on its website, part of its pledge to show customers “the true cost of every product we make.” (The New York Times has a collaboration with Everlane in which nine public school students receive free access to the news organization’s website for a year for every T-shirt or sweatshirt sold from the retailer’s “Climate Collection.”)

Over the past few years, as China has become more prosperous, Everlane has moved substantial production into countries like Vietnam and Sri Lanka. But the production of some items, like cashmere and silk garments, are virtually impossible to move out of China in part because of where the delicate materials come from. Mr. Preysman pointed to the substantial amount of cashmere that comes from Inner Mongolia.

While the Trump administration has said that its trade war with China will bring jobs back to the United States, Mr. Preysman said that shifting clothing production to America wouldn’t make sense for a company like Everlane. He said factors like the location of raw materials, the time it takes to build a United States factory and the company’s small size would all make it too difficult.

“You’re basically removing jobs out of China and pushing them into places like Vietnam,” Mr. Preysman said. “This punishes China in a major way, it punishes the U.S. consumer temporarily and then eventually, hopefully, we find ways to move things around. We by no means want to raise prices on our customer ever — our goal is to reduce pricing.”

For products it can’t move out of China, Everlane is figuring out how to manage prices and its margins, so that it doesn’t have to actually increase the price of a cashmere sweater to $124 from $100. (It will be harder for companies with lower margins to absorb the higher costs of products hit by tariffs.)

It may accelerate production and pay extra in transportation costs to move garments to its main warehouse in Kutztown, Pa., before the tariffs take effect. For example, if it ends up racing to get certain garments into the country before mid-July, it could mean having the goods come by plane instead of boat. It might then suddenly cost $1.50 or $2 per item moved versus 50 cents.

The company can petition for exemptions from new duties for specific circumstances, though there are no guarantees around whether the petitions would be granted. Everlane plans to petition for silk and cashmere items.

“We can attempt to take something like silk and say we can’t move this because it’s from China, China’s famous for silk and we’d like to petition for some time and would like to find an alternative source to lower the duties on this,” Mr. Preysman said.