Settling allegations of discrimination filed by the Massachusetts attorney general’s office, Mutual of Omaha has agreed not to deny insurance to people who use medications to prevent H.I.V. infection.

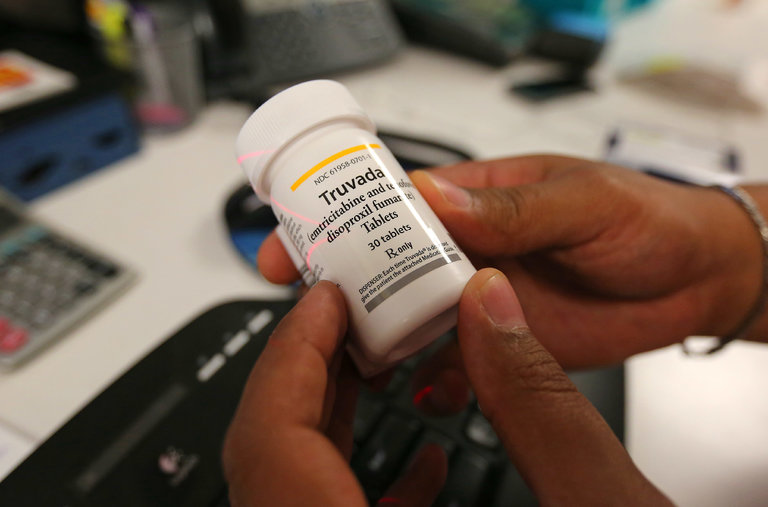

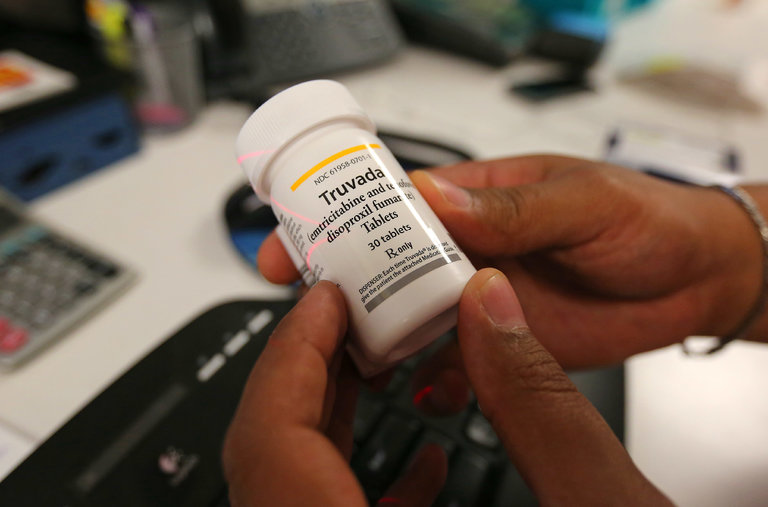

The insurer also has settled a lawsuit brought by an unidentified gay man in Massachusetts who was turned down for long-term-care insurance after acknowledging that he took an H.I.V.-prevention drug called Truvada.

“Consumers looking to protect themselves from H.I.V. transmission should not be excluded from buying insurance,” Maura Healey, the attorney general of Massachusetts, said in a prepared statement.

The company admitted no wrongdoing in the settlements and will make a $25,000 payment to the state.

Mutual of Omaha became the focus of discrimination complaints after applicants, mostly gay men, said they were denied disability, long-term-care or life insurance solely because they were taking Truvada to protect themselves from H.I.V., a practice called PrEP (short for pre-exposure prophylaxis).

The Centers for Disease Control and Prevention urges men and women at risk for H.I.V. infection to take Truvada daily. Studies have shown the drug to be extremely effective at blocking the virus, and health insurers almost always cover the cost.

Some gay men said that they stopped taking Truvada, potentially endangering themselves, simply to obtain insurance. After The Times reported the denials last year, regulators in New York also began investigating insurers in the state to see if they were engaged in similar practices.

Mutual of Omaha’s agreement with the Massachusetts attorney general applied only within that state. But the company has now revised its evaluation practices nationwide, said Andy Halpern, a spokesman for the insurer.

Like other insurers, Mutual of Omaha has underwriting guidelines that are mostly proprietary and hidden from public view. Customers who want to buy long-term-care, life or disability insurance are evaluated and rated.

Some conditions, including H.I.V. infection, are sufficient for an insurer to deny coverage. But Mutual of Omaha’s denials in more than a dozen cases were based not on medical status but on use of a medication by healthy people, according to Bennett Klein, an attorney at GLBTQ Legal Advocates and Defenders in Boston.

Mr. Klein, who represented the gay man who was denied long-term-care insurance, argued that the policy amounted to discrimination on the basis of sexual orientation, since 80 percent of people who take Truvada are gay men.

Mutual of Omaha “regarded them as disabled, the same way as they would exclude a person who has H.I.V.,” Mr. Klein said. To company evaluators, the fact that an applicant was on PrEP meant that he was by definition at high risk for H.I.V. infection.

“But they don’t otherwise assess H.I.V. risk,” Mr. Klein added. “They don’t ask if you engage in unsafe practices or do you use a condom.”

Mutual of Omaha’s concessions are “fantastic,” said Scott Schoettes, H.I.V. project director for Lambda Legal, an L.G.B.T. advocacy group.

“Now we need the rest of the insurance industry to fall in line and realize that if they don’t, they will face legal actions against them,” Mr. Schoettes added.